Magnetic Resonance Imaging (MRI) plays a critical role in cancer diagnosis and treatment planning. From detecting early tumors to monitoring therapy effectiveness, MRI provides life-saving insights for patients and doctors alike. But while the medical importance of MRI is undeniable, many patients find themselves asking: Will my insurance cover the cost?

The answer depends on multiple factors, including your health insurance provider, your policy details, and how the MRI is classified—whether as a medically necessary procedure or an elective one. This article explores how insurance coverage works for MRI scans in cancer care, common challenges patients face, and practical steps to minimize out-of-pocket costs.

Why MRI Matters in Cancer Diagnosis and Treatment

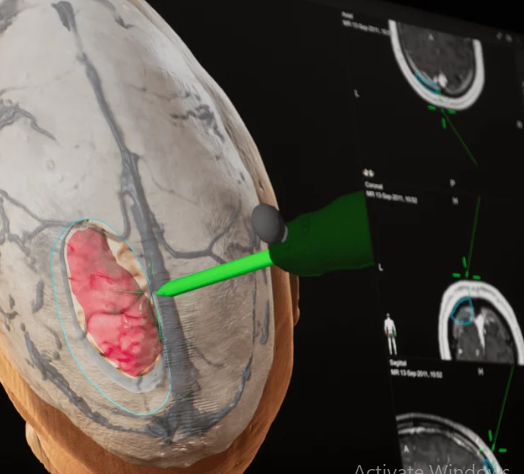

MRI is one of the most advanced imaging technologies available. It produces detailed images of soft tissues without exposing patients to radiation. In oncology, MRI is often used for:

- Detecting early-stage tumors in organs such as the brain, breast, prostate, and liver.

- Determining cancer stage, which guides treatment options.

- Monitoring treatment effectiveness, helping oncologists adjust therapies when needed.

- Surgical and radiation planning, allowing for more precise interventions.

Because MRI scans are often essential for cancer care, most insurers consider them medically necessary—but there are exceptions.

Does Health Insurance Cover MRI Scans for Cancer?

In most cases, yes. Health insurance policies generally cover MRI scans when they are ordered by a physician for cancer diagnosis or treatment monitoring. However, coverage varies depending on:

1. Type of Insurance Plan

- Private insurance: Typically covers MRI, though patients may face copays, deductibles, or coinsurance.

- Medicare: Covers MRI if it is deemed medically necessary and performed in an approved facility.

- Medicaid: Coverage depends on the state, but MRIs for cancer diagnosis are often included.

2. Medical Necessity

Insurance companies usually require proof that the MRI is medically necessary. This means the physician must provide documentation explaining why the scan is needed for diagnosis, staging, or treatment planning.

3. Prior Authorization Requirements

Many insurers require pre-approval (prior authorization) before covering an MRI. Without this step, patients may face unexpected bills even if the scan was necessary.

4. Network Restrictions

Coverage may be reduced or denied if the MRI is performed outside of the insurer’s network. Choosing in-network hospitals or imaging centers can lower costs significantly.

Common Challenges Patients Face with Insurance Coverage

Even when insurance covers MRI scans, patients often encounter financial or administrative hurdles:

- High deductibles and copays: Patients may still be responsible for hundreds or even thousands of dollars.

- Denials due to lack of prior authorization: Insurance companies may refuse to pay if proper approval wasn’t obtained.

- Delays in care: Waiting for authorization or appeal processes can postpone diagnosis and treatment.

- Coverage gaps for specialized MRIs: Advanced MRIs (e.g., breast MRI with contrast) may not always be fully covered.

These barriers can discourage patients from seeking timely imaging, which can have serious consequences for cancer outcomes.

Strategies to Navigate Insurance and Reduce Out-of-Pocket Costs

Patients can take several steps to manage MRI costs and improve the likelihood of insurance coverage:

1. Confirm Coverage Before the Scan

Always check with both your physician and your insurance provider before scheduling an MRI. Ask:

- Is this MRI covered under my policy?

- Do I need prior authorization?

- What are my expected out-of-pocket costs?

2. Use In-Network Providers

Choosing an in-network imaging facility helps avoid unexpected charges and ensures maximum coverage.

3. Request Prior Authorization

Work with your physician’s office to submit the necessary paperwork in advance. This step is critical for avoiding denials.

4. Explore Financial Assistance Options

If insurance doesn’t cover the full cost, hospitals, nonprofit organizations, and cancer support groups may offer financial aid or discounted rates.

5. Appeal Denied Claims

If your insurance company denies coverage, you have the right to appeal. Providing additional medical documentation can often reverse the decision.

6. Compare Facilities for Lower Costs

Outpatient imaging centers often charge significantly less than hospitals. Patients can ask for quotes before scheduling.

Special Considerations for Cancer Patients

Some cancer patients may need multiple MRIs throughout their treatment journey. This makes insurance coverage even more crucial. Here are a few points to keep in mind:

- Surveillance MRIs: Long-term cancer survivors may require periodic scans to check for recurrence. Coverage is usually granted when physicians deem these necessary.

- Experimental or advanced MRI techniques: Some new imaging methods may not yet be covered by insurance. Patients may need to discuss alternatives or financial support.

- Multiple imaging types: If MRI is paired with CT scans, PET scans, or ultrasounds, coverage for each may vary.

Global Perspective on MRI Insurance Coverage

- United States: Insurance coverage is widespread but often costly due to deductibles and copays.

- Europe: Most countries with public healthcare systems cover MRIs fully when medically necessary, though wait times can be long.

- Low- and middle-income countries: MRI access is limited, and costs are often out-of-pocket, creating serious barriers to cancer care.

This global inequality underscores the need for reforms and policies that ensure equitable access to diagnostic imaging.

The Future of Insurance and MRI Coverage

As MRI technology evolves, insurance policies must adapt. Promising developments include:

- Value-based insurance models that emphasize preventive care, including cancer imaging.

- Government programs expanding coverage for early cancer detection.

- Technological innovations such as portable MRIs, which could lower overall costs and broaden coverage.

If these trends continue, patients may face fewer financial barriers when accessing this critical diagnostic tool.

Conclusion: What Patients Should Know

For cancer patients, MRI scans are not optional—they are a cornerstone of accurate diagnosis and effective treatment. While most insurance plans cover MRIs when medically necessary, patients often face hurdles like prior authorization requirements, network restrictions, and high out-of-pocket costs.

By being proactive—confirming coverage, choosing in-network providers, and exploring financial assistance—patients can reduce their financial burden and ensure timely access to MRI scans.

Ultimately, health insurance should serve as a bridge, not a barrier, to cancer care. Patients, providers, and policymakers must work together to create a system where every cancer patient has affordable access to the diagnostic imaging they need.

Also Read :