JPM US Technology D Acc EUR: An Excellent Fund for Technology Speculators

A mutual fund called JPM US Technology D Acc Eur focuses mostly on US firms in the technology sector. The fund, which is managed by J.P. Morgan Asset Management, seeks to give investors long-term capital gain.

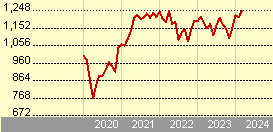

JPM US Technology D Acc Eur can be an appropriate choice for investors wishing to gain exposure to the technology sector. The fund makes investments in a wide range of technology-related businesses, such as media, communication services, and technology. The fund has produced a 3 year annualized return of 7.77% in EUR as of July 2024, and a year-to-date return of 21.78%.

JPM US Technology D Acc Eur might be a solid option for individuals looking for overall exposure to the field of technology. Before making a choice, it is crucial to thoroughly analyze one’s investing objectives, risk tolerance, and investment horizon, just as with any other investment.

Overview of Funds and Investment Approach

A mutual fund called JPM US Technology D (acc) – EUR makes investments in the US technology industry. The fund invests mostly in technology businesses with headquarters or operations in the United States in an effort to generate long-term capital growth. The fund manager selects stocks using a bottom-up strategy, giving special attention to businesses with solid growth potential and fundamentals. The fund may also make investments in media and telecommunications, two industries that are closely associated with the technology sector.

Performance of Funds

A fund called JPM US Technology D (acc) – EUR has provided investors with substantial profits during the last few years. As of July 8, 2024, the fund has returned 38.67% over the previous year and 29.69% over the previous three years, according to Morningstar. Nevertheless, previous performance does not guarantee future outcomes, and the fund’s future success is not guaranteed.

Profile of Risks

There are risks associated with investing in the JPM US Technology D (acc) – EUR fund. The portfolio has a large amount of exposure to the volatile and quickly changing technology industry. The fund may also make investments in smaller businesses, which could be more vulnerable to dangers and economic downturns. There is always a chance of losing money when making an investment, because Prior to making an investment in the fund, one should carefully assess their financial goals and risk tolerance.

Top Holdings in the Portfolio Details

The main asset class of the JPM US Technology D (acc) EUR fund is US technology businesses. There are forty holdings in the fund as of the last report. 55.94% of the portfolio’s total value is comprised of the top 10 holdings. Apple Inc., Microsoft Corporation, and Alphabet Inc. are the fund’s top three holdings, accounting for 16.39%, 12.26%, and 9.12% of the portfolio, respectively.

Sector Distribution

With 71.80% of the portfolio, information technology is the sector in which the fund is most strongly allocated. With 12.94%, 5.16%, and 4.82% of the portfolio, respectively, communication services, consumer discretionary, and healthcare are the next largest sectors.

Exposure by Geography

The fund makes investments in US-based businesses that comprises 99.68% of the whole portfolio. The portfolio’s remaining 0.32% is made up of cash and cash equivalents.

All things considered, the JPM US Technology D (acc) EUR fund has a significant concentration on the technology industry and a strong emphasis on US-based businesses. Bullish investors in the US technology sector could find this fund to be a compelling choice. Nonetheless, the concentration risk connected to investing in a particular industry should be understood by investors.

Commonly Asked Questions

What is the JPM US Technology D Acc EUR fund’s current price?

The price per share of the JPM US Technology D Acc EUR fund is EUR 82.30 as of right now.

Could you enumerate the top holdings in JPM US Technology?

D Acc money in euros?

As of June 2024, the top holdings in the JPM US Technology D Acc EUR fund are as follows, according Morningstar:

Microsoft Corp. Apple Inc.

Amazon.com, Inc.

Google Inc.’s Class A

Instagram Inc.

Is dividend distribution available for the JPM US Technology D Acc EUR fund?

Since the JPM US Technology D Acc EUR fund is an accumulation product, dividends are not paid out. Rather, the fund automatically reinvested whatever money it generates, which allows for future development.

Which investment approach is employed by the JPM US Tech Leader Strategy?

The JPM US Tech Leader Strategy is an actively managed equities approach that aims to invest in technology businesses with robust growth prospects.

potential. The approach concentrates on businesses with a competitive edge and leaders in their corresponding subsectors.

Which technology are the most important ones that JP Morgan uses in its operations?

Global banking giant JP Morgan supports its operations using a variety of technological tools. The organization has adopted several critical technologies, such as blockchain, artificial intelligence, cloud computing, and cybersecurity solutions.

What types of exchange-traded funds (ETFs) does JP Morgan participate in?

JP Morgan is included in many exchange-traded funds (ETFs): JPMorgan Ultra-Short Income ETF, JPMorgan Diversified Return US Equity ETF, and JPMorgan BetaBuilders US Equity ETF.

Also Read :