How to Build a Winning Retirement Investment Strategy: Key Steps to Ensure Your Financial Future.

An investment strategy for retirement is the key to having peace of mind and being financially free in old age. Setting clear goals, understanding risk tolerance, and choosing a mix of correct investments provide a very good base for one’s future. Most people miss the parts about starting early and ensuring their investments match their personal values and way of living.

One need not be intimidated by investing for retirement. Some careful planning will help anybody find his way through the copious options available. Meticulous planning, timely and periodic contributions, and periodic reviews to bring about relevance in terms of alterations that take place comprise your journey toward financial independence.

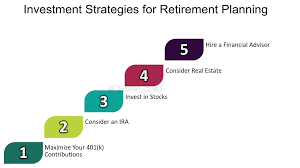

The right strategy formulated today can save much heartache tomorrow. Decide upon concrete steps now that will see you better-placed for a comfortable retirement.

Key Takeaways

Set up clear financial goals for the investment decisions. Be aware of your tolerance to risk so that you can make informed decisions. The strategies of investments should be reviewed and updated on a regular basis. Making Out Your Investment Strategy A proper and victorious investment strategy demands proper planning. It is important to assess risk tolerance, understand asset allocation, diversify the portfolio, and set realistic goals. The steps will help ensure a sound path to a secure retirement.

Assessing Risk Tolerance

An investor’s risk tolerance is the amount of risk he or she is willing to undertake. This factor has a determination founded on an investor’s financial position, investment goals, and their feelings toward the fluctuations in the market.

Some questions may be useful in making this determination:

How many years until retirement?

How much can they afford to lose and still maintain their lifestyle?

Are they comfortable with the fluctuation of markets?

Risk tolerance will help determine the type of investment an individual should invest in. Greater risk typically rewards with greater return; however, not everyone has the constitution to withstand stressful market ups and downs.

Understanding Asset Allocation

Asset allocation is the process of determining how much to invest in different asset classes. A wise portfolio typically includes stocks, bonds, and cash.

Following are typical portfolio allocation plans:

Conservative: 20% Stocks, 50% Bonds, 30% Cash

Low-risk: 30% Stocks, 60% Bonds, 10% Cash

Moderate risk : 50% Stocks, 30% Bonds, 20% Cash

Aggressive: 80% Stocks, 15% Bonds, 5% Cash

The correct allocation is according to the risk tolerance and investment horizon. A young investor may prefer investing in stocks to improve growth while an investor on the verge of retirement might give importance to the safety of bonds. It is always important that the asset mix be reviewed and changed regularly as circumstances do change.

Diversifying Your Portfolio

Diversification is an investment strategy whereby an investor spreads investments across different assets classes to minimize risk. Diversification prevents too much concentration or exposure to any single investment.

The following represent ways to diversify a portfolio:

Investing in several sectors, like technology or health care

Having both domestic and international stocks

Mixing asset classes, such as stocks, bonds, and real estate

By doing so, it allows the investors to have resilience amid market turbulence. If one of the assets declines, the others may compensate for those losses. A well-diversified portfolio normally experiences more predictable returns over time.

Setting Realistic Goals

An investment plan must have goals. These goals should be SMART: specific, measurable, achievable, relevant, and time-bound.

Examples:

Accumulation of $500,000 for retirement in 20 years

Growing a college fund into $50,000 in 10 years

Such goals are designed to be reviewed periodically to adjust to changed circumstances. Maintaining flexibility keeps an investor focused and motivated. Progress against these goals may be helpful in providing needed feedback that could very well guide future investment decisions.

Implementing Your Strategy

Implementation of a retirement investment strategy involves careful selection of investment vehicles, keeping pace with the market, periodic rebalancing of the portfolio, and tax planning. All of these may have a deep impact on the return an investment plan will get.

Selection of Investment Vehicles

The very first step of this implementation is to choose the right kind of investment vehicles. The common ones are stocks, bonds, mutual funds, and exchange-traded funds.

Stocks are shares in companies; they can yield high returns. Bonds essentially are loans given to companies or governments and typically offer lower, but safer, returns. Mutual funds pool money from many investors together to invest in various assets, thereby offering diversification. ETFs are similar to mutual funds but trade on an exchange like stocks, often having lower fees. Investors have to decide on the instrument they want to choose based on factors such as their risk tolerance, investment time frame, and goals.

Staying Up to Date with the Market

Knowing the trends in the market is rather quite necessary in making a worthy investment decision. Such knowledge involves a regular overview of economic indicators, interest rates, and political events.

Economic indicators, like unemployment rates, would give a hint on the market’s health.

Interest rates may influence the rates of borrowing and investment returns.

One can get updated from financial news websites, market analysis reports, and investment forums. Periodic researches help learn about the shifts in the market so that one can adjust an investment strategy on time.

Rebalancing Your Portfolio Regularly

Regular rebalancing of a portfolio ensures that it maintains the optimum level of risk and investment objectives. Over time, some investments will perform better than others and may alter the designated asset allocation.

For example, if stocks are performing well, they might begin to form the largest percentage of a portfolio than what was desired.

The investor must sell some of the appreciated assets and purchase more of the underperforming assets in order to rebalance.

This keeps the portfolio aligned with the original strategy and avoids excessive risk from being too concentrated in one asset class.

Tax Efficiency Planning

Planning for tax efficiency is very important to maximize net returns from investments. There are various types of accounts with different taxation; using them appropriately matters.

Tax-advantaged accounts, such as IRAs or 401(k)s, are tax-free until withdrawn.

Tax-loss harvesting sells losing investments to offset gains. Added to that, investors should also bear in mind the capital gains tax levied against them after they sell investments at a profit. Understanding and preparing for taxation can help tremendously in order to secure better results in the long run.

Also Read :

- How Blockchain Technology is Revolutionizing Industries

- Computer Engineering: The backbone of the development of modern technology.

- Technology in Marketing 2024

- Technology Consulting

- Financial Technology Consulting