Liver cancer is a serious and often life-threatening disease, but early …

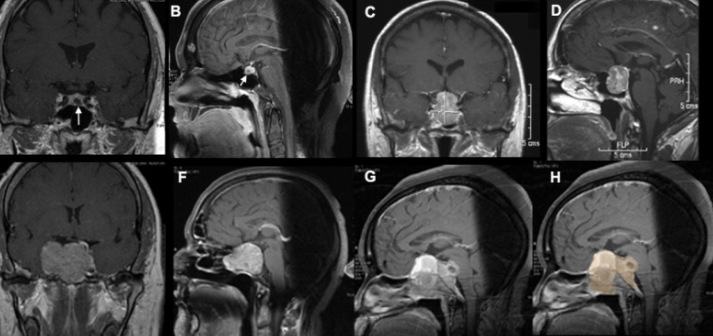

MRI in Brain Tumor Diagnosis: What You Should Know

Brain tumors are among the most challenging conditions to diagnose and …

How MRI Helps Monitor Prostate Cancer Progression

Prostate cancer is one of the most common cancers among men …

Using MRI to Detect Breast Cancer Early

Breast cancer is one of the most common cancers worldwide, and …

Why Your Doctor Might Recommend an MRI for Cancer

When facing a possible cancer diagnosis, your doctor may suggest several …

The Role of MRI in Staging Cancer

Cancer diagnosis is not just about finding a tumor—it’s also about …

How MRI Works in Cancer Diagnosis: A Beginner’s Guide

Cancer is one of the most challenging diseases to diagnose and …

MRI vs CT Scan: Which Is Better for Cancer Detection

When it comes to detecting cancer, medical imaging plays a crucial …

What Is MRI and How Does It Help Detect Cancer?

Magnetic Resonance Imaging (MRI) has become one of the most powerful …

How a Medical Marvel Could Power the Planet

Few inventions have transformed healthcare as dramatically as Magnetic Resonance Imaging …