How Tokenomics Works: Unveiling Value Understanding of Cryptocurrencies Basically, if one is to understand the way in which cryptocurrencies derive their value, it is important to understand this concept of tokenomics. In essence, a portmanteau of “token” and “economics,” the study of factors that influence digital currencies’ supply and demand. The general utility of a cryptocurrency, scarcity, and the technology behind mainly determine its value.

Most people find cryptocurrencies to be a bit puzzling, but with Tokenomics, one gets back on track because it denotes what actually drives the value in this digital space. Studying the economic models behind these cryptocurrencies can really help to understand why some coins increase or fall in value.

These are important details to have for those interested in investing or using cryptocurrencies. These are explanations of market trends that give insights to help you differentiate between sustainable coins and those not worth your investment.

Key Takeaways

- Tokenomics pertains to the study of how cryptocurrency takes on value.

- Some impactful elements of value include utility, scarcity, technology, etc.

- With a good understanding of tokenomics, one can make well-informed investment decisions.

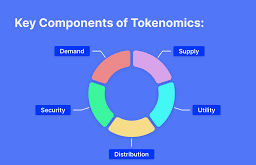

Fundamental Element of Tokenomics

In principle, tokenomics attempt to explain how a cryptocurrency acquires its value. In theory it speaks to supply and demand, utility, scarcity, and even shows the impact of consensus mechanisms. Each of these elements is important in determining the value of a token.

Principle and History of Tokenomics

The word Tokenomics is a combination of the word “token” and “economics.” It reflects the economical rules related to blockchain tokens. When cryptocurrencies started to gain popularity, the term appeared.

Tokens have multiple uses. Some are used as representations of assets, while others are utilities in their respective platforms. Understanding what the token does will answer what it is worth or its value.

Tokens were born with Bitcoin back in 2009 and brought to the world the concept of digital money that would be decentralized. Since then, many tokens are developed for various reasons. Nowadays, they might represent everything: from digital art to services.

Demand and Supply Dynamics

Demand and supply are the basic source components of token value. When demand is high and supply low, prices tend to surge upwards. Correspondingly, in cases of oversupply, tokens may see their prices drop.

Most cryptocurrencies have capped supply. For instance, Bitcoin has a capped supply of 21 million. This can create demand due to scarcity. New tokens can implement structured releases called token burns or some form of a halving event, where it reduces the supply at regular time intervals.

Trends within markets have significant impacts on supply and demand. News, events, and overall market sentiment concerning demand changes that can change in a day is all kept in view by investors while assessing the potentials of tokens.

Role of Utility and Scarcity

Utility can be described as a word for the usefulness of a token. The tokens with highly built utility usually have more value. The tokens can be utilized in transactions, usually in governance, or sometimes to access services.

Scarcity is related very closely to utility. If there is not much of a given token, people usually want it more. For example, exclusive features being provided with a token may grant more users than usual.

Utility and scarcity are two elements that investors tend to look for in a token, as these provide an indication of growth in many instances. A well-rounded token is one that can bring valuable long-term utility to its holders.

Impact of Consensus Mechanism

Consensus mechanisms go to securing blockchain networks. They ensure the integrity of transactions that are being verified and recorded. Popular ones include proof-of-work and proof-of-stake mechanisms.

PoW secures the network by means of extensive, intensive computations. This energy-intensive process places pressure on token value, as the deterrence coming from high energy costs is bound to make participation fall and hence affect scarcity.

In contrast to PoW, PoS can allow block validators to validate a proportion of their holdings. In fact, it may give value to tokens because it incentivizes users to hold and not sell their tokens.

It is necessary to learn how these mechanisms work to estimate the prospective value of a token. They establish a structure that regulates supply and demand and stimulates activity in the market.

Value Determination in Cryptocurrencies

Several factors influence how cryptocurrencies derive value. Market sentiment and speculation go hand in glove with technological progress and regulations, which shape investors’ perceptions and their decisions.

Market Sentiment and Perception

Market sentiment is the overall feeling or attitude of investors in a given cryptocurrency or, as a whole, the market. News, therefore, that reflects positively, such as partnerships or successful product launches, could help build interest and prices.

Opposite to that, negative events such as hacks, regulatory actions, or market crashes could lead to panic selling.

Investor behavior is very trend and emotion-driven; therefore, social media and news outlets are very important to monitor when trying to determine the sentiment of the investing public. Specific tools, such as sentiment analysis platforms, give a sense of the overall feeling about a cryptocurrency and perhaps insight into potential investment opportunities.

Speculation

The prices of every cryptocurrency take speculation into immense consideration. A large number of investors buy coins on speculation that their prices will increase. This artificially drives up the price independent of the fundamental factors that surround the cryptocurrency.

On the other hand, positive speculation about the forthcoming technology updates or market trends drives enormous investments. Contrarily, this negative speculative measure leads to sharp drops in value.

Mostly, this speculation behavior causes high volatility in cryptocurrency markets. A trader needs to know that where speculation brings in profit, it also carries risk factors for losses.

Technological Advances and Innovation

The main technological advancement goes hand in hand with the value being given to cryptocurrencies. Innovations such as scalability improvements or security upgrades can set a coin apart from its competition.

For example, a cryptocurrency implementing faster transaction processing is also able to harvest additional users, who drive up its value.

This can also be a source of heightened trust and, consequently, increased usability. Events such as updates and breakthroughs may affect investor confidence in a cryptocurrency. Mostly, investors will also closely monitor the development roadmap of a cryptocurrency project, since any major improvement or upgrade will typically see its price increase due to perceived utility and functionality.

Effects of the Regulatory Environment

The legal environment that concerns cryptocurrencies can be a strong determinant of their value. Most governments are capable of placing restrictions or coming up with friendly laws that affect market confidence.

Any positive regulatory news, such as a nod from financial institutions or friendly legislation, is sure to see the prices rise. On the flip side, strict regulations or outright bans create uncertainty that causes the prices to plummet.

Investors need to be in the know of every change in laws and regulations to understand how it all works when it comes to potential risk and reward. Knowing a cryptocurrency’s legal standing in jurisdictions is very important for an assessment of its value potential.

The point is where numerous individuals involved in cryptocurrencies meet and come into contact with one another. Clearly, an understanding of how AI and Blockchain work together will lead to better investment strategies and wiser decisions in this fast-moving market.

Key Takeaways

- AI enhances data analysis and decision-making for crypto markets.

- Blockchain offers security and transparency for digital transactions.

- A combination that inspires innovation and builds trust among its users.

Fundamentals of AI and Blockchain Integration

Artificial intelligence can be merged with blockchain to provide an opportunity for solving issues within the crypto area. The integration has presented great potential and also some challenges that need careful consideration.

Defining AI and Blockchain

Artificial Intelligence refers to machines or software that can replicate human intelligence. It can analyze data, recognize patterns, and make decisions. Examples include chatbots and recommendation systems.

The blockchain, on the other hand, is a decentralized, recorded transaction in a secure manner. It allows multiple visibilities of the same data without the need for a central authority. A block contains the details of transactions, and these blocks are then securely linked.

Together, AI and blockchain build new dimensions for improving security and efficiency in crypto transactions.

Potential and Challenges

The integration of AI into blockchain is a very promising venture. AI can improve transaction speed and accuracy. It also amplifies security, with the identification of fraud and unusual activities in real time.

Despite these advantages, there are drawbacks that one can face. AI needs enough data, which can raise privacy issues. Besides, the complexity of the integration itself may create obstacles. There is a risk of over-reliance on AI and committing potential mistakes.

These challenges call for stakeholders to be very careful if full benefits are to be realized.

Operational Key Technologies and Innovations

There are many technologies driving the integration of AI and blockchain. Among the key innovations at the front line in this area is the use of smart contracts. They execute agreements automatically, based on a set of pre-defined conditions that reduce the need for intermediaries.

Other technologies include machine learning, which enables the AI systems to get better with patterns of data analysis. In the context of blockchain, it would allow improving the accuracies of predictive models used for financial forecasts.

Decentralized AI platforms are emerging as well. With the use of blockchain, such platforms guarantee data privacy yet grant AI access to diverse datasets to learn.

Innovations like these shape a future in crypto that will make the integration of AI and blockchain one of the key areas to watch.

AI and Blockchain in Crypto Landscape

Artificial intelligence and blockchain remake the way in which cryptocurrencies have functioned. This combines to create smart systems for trading, contracting, security, and organization. It is a point of great potential and improvement that can be achieved with regard to efficiency and safety in the crypto market.

Enhancing Smart Contracts with AI

Smart contracts are self-executing agreements with the terms of an agreement written directly into lines of code. AI can enhance their functionality by making them more adaptive and intelligent. For example, AI algorithms can analyze data and make changes in the terms of the contract without human intervention, based on specific triggers.

AI can also help monitor compliance and performance. It can very quickly identify whether the conditions of a contract have been satisfied or whether it needs any adjustment. Automation does this, which limits the probabilities of human error. This builds trust among parties.

Crypto Trading and Market Predictions

AI plays a very important role in the analysis of market trends and prediction that goes on within crypto trading. Machine learning algorithms look for vast volumes of data to find the patterns in them, which otherwise might not be visible to the human eye. Insights derived from such patterns help the trader make better decisions.

Additionally, AI will be able to automate trading strategies. Through real-time data, algorithms can detect, predict, and execute trades for maximum profit and minimum losses. This is the competitive edge that traders have because of the volatility in the crypto market.

Fraud Detection and Security

Fraud has also left a dent in the world of crypto. The architecture of security systems supported by AI can prevent fraudulent activities. AI detects abnormalities in the pattern of transactions to flag them for further investigation.

With time, the machine learning models become increasingly capable of recognizing potential threats. In this respect, such proactive action helps to protect users and build trust in blockchain systems. This efficient fraud detection protects investment and preserves the integrity of the crypto ecosystem.

DAOs

DAOs are organizations operating through smart contracts built into a blockchain; AI enhances decision-making processes. Analyzing data and results, the AI allows DAOs to make better decisions matching member preferences with market conditions.

Added to that, AI can further develop DAO governance by speeding up the voting processes and gathering insight from the members at great speeds. This in itself stimulates participation and enhances the effectiveness of DAOs in general, hence increasingly more viable in the crypto space.

Also Read :