How to Earn Crypto Rewards with DeFi: Step-by-Step Guide to Maximum Return Crypto rewards through decentralized finance have been one of the most hot topics people are looking at to grow their digital wealth. It normally rewards users in return by taking part in DeFi, which could be in such forms as lending, staking, or liquidity provision. This article will try to explain how these opportunities work and provide easy steps on how you can get started earning crypto rewards.

Knowledge of the use of DeFi platforms in this fast-moving world of cryptocurrency opens up a whole world of financial possibilities, full of various earning methods that will provide better returns than traditional finance. Interaction with DeFi protocols allows users to have more control over their investments while benefiting from innovative financial tools.

In this rapidly scaling ecosystem, the onus remains with DeFi users to become better informed and seek out the best strategies that fit their goals. By educating themselves on how to optimize crypto rewards, they can reap the most value from their investments in this space.

Key Takeaways

- Engage in DeFi with potentially high crypto rewards.

- Knowing different ways of earning helps make informed decisions.

- How to earn more using DeFi platforms effectively is about maximizing returns.

How DeFi Works

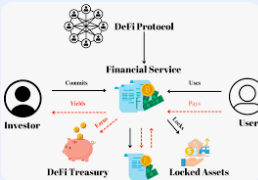

DeFi deploys blockchain technology to provide financial services unrelated to traditional banks. Users can receive rewards through several different means. Here are some of the most critical things to know about DeFi.

How DeFi Works

DeFi consists of financial systems built on blockchain networks. Contrary to traditional finance, DeFi functions without a central governing authority. In their place, smart contracts automate processes and speed up transaction times, reducing the cost of transactions.

DeFi platforms facilitate loans, trading, and savings to their users. Most of the services provided by these platforms require cryptocurrencies instead of fiat money. This transition allows more inclusion into financial activities that hitherto were not available to unbanked people.

Most of the DeFi projects make use of dApps. Examples of dApps services include yield farming and providing liquidity. In such cases, one can earn interest or a reward from an investment.

Types of Crypto Rewards in DeFi

DeFi crypto rewards can be given in several manners. Major types include:

- Yield farming: Providing liquidity to platforms in return for getting interest or tokens.

- Staking: Users lock their cryptocurrencies on a network for operational support; in return, users get rewards.

- Liquidity pools: Users deposit tokens into the pools, thereby facilitating trading in decentralized exchanges; accordingly, fees collected are accorded to them as reward.

The reward offered by various platforms differs. Rates can range from minimal to very high; hence, a user may want to research to get decent options.

Risks and Considerations

Although DeFi gives an edge over traditional finance, using the service comes with some risks. Firstly, smart contracts may contain bugs that could give way to losses. Users are expected to vet the protocols well before investing.

Secondly, market volatility will influence rewards. In turn, price changes may change within minutes, influencing either gains or losses.

Finally, there is little regulation in DeFi. This advances the fraud or scamming possibility. One should always be wide awake and take great care.

Understanding these risks will allow users to make informed decisions in the DeFi space.

How to Maximize Crypto Rewards

Crypto rewards can be realized with good planning and making smart choices. Picking up the right platforms, being involved in liquidity pools, and working out effective strategies are ways whereby returns can be optimized.

How to Choose a DeFi Platform

Selection is very important with any DeFi platform. You will want to make sure you choose a well-reputed platform that has an intuitive interface and top-notch security. Some of the main points to consider when choosing a DeFi platform include:

- Liquidity: The platform should be liquid enough to handle your transaction. This will help in avoiding high slippage rates.

- Fees: Check for trading and transaction fees. Lower fees can be all the difference in overall gains.

- Rewards Programs: Some exchanges have additional rewards for the users like bonus tokens or other referral benefits.

Study and reviews will help to find the most appropriate option. The right choice can increase the reward-earning possibilities.

Participation in Liquidity Pools

In DeFi, liquidity pools perform an important role. An investor can contribute his assets and start earning rewards. Following is a guide on how one can maximize returns:

Selection of Popular Pool: One must select those pools which are witnessing high volume during trading. These pools generally provide higher fees.

Impermanent Loss: When the price of assets is changed, then impermanent loss occurs. Remembering this risk will save potential gains.

Tokens: Most pools reward liquidity providers in the form of tokens. Staking or trading these tokens can add more profits.

By being an active participant, an investor can increase his profits substantially.

Yield Farming Strategies

Yield farming allows users to provide rewards by shifting assets on different platforms. Yield farming can be done with a few very effective strategies:

- Diversification: The investment should be spread over various platforms or pools. In this way, the risks are reduced, and the earnings get stabilized.

- Rebalancing: Keep on looking around and change into those pools which offer better returns. The more informed one is, the better the rewards that come one’s way.

- Long-term commitment: Many platforms reward better if the participant remains committed for a longer period.

These strategies will go a long way in optimizing the returns with managed risks.

Staking and Proof of Stake

Staking is the process of locking a number of tokens to support the network in question. Many offer rewards, usually paid in the same token. Key considerations are as follows:

- Minimum Requirements: Each staking platform provides a requirement for minimum staking. Make sure you meet them, whether high or low.

- Reward Rates: Different platforms have different staking rates. High rates will bring better returns.

- Duration: Some platforms provide much greater returns with longer asset locks. Understand the terms.

It is a secure method of generating passive income in DeFi.

Lending and Borrowing

Lending platforms allow the lending of crypto assets to people in return for interest. Meanwhile, taking a loan leverages your investment. Key Factors to Consider:

- Interest Rate: See the rate of interest offered for lending and borrowing. Higher rates are indicative of good earnings.

- Requirement for Collaterals: Most of these sites require collaterals in exchange for loans. Make sure it is within reasonable limits.

- Risk Assessment: Assess the likely risks in lending platforms, such as defaults of loans. Select platforms characterized by robust risk management. Allow the lending and borrowing activities to diversify portfolio returns and optimize the earnings.

Also Read :